Introduction

Financial crises can have profound and long-lasting effects on the global economy. Comparing the current financial crisis with the 2008 crisis provides valuable insights into the key differences and lessons learned. This article explores the causes, impacts, and policy responses associated with both crises, highlighting critical distinctions and examining how lessons from 2008 can guide policymakers in addressing today’s financial challenges.

Understanding the 2008 Financial Crisis

Causes and Contributing Factors

The 2008 financial crisis, known as the Great Recession, was triggered by the collapse of the U.S. housing market bubble and the subsequent failure of mortgage-backed securities. Contributing factors included excessive risk-taking by financial institutions, lack of transparency in the financial system, and inadequate regulation and oversight.

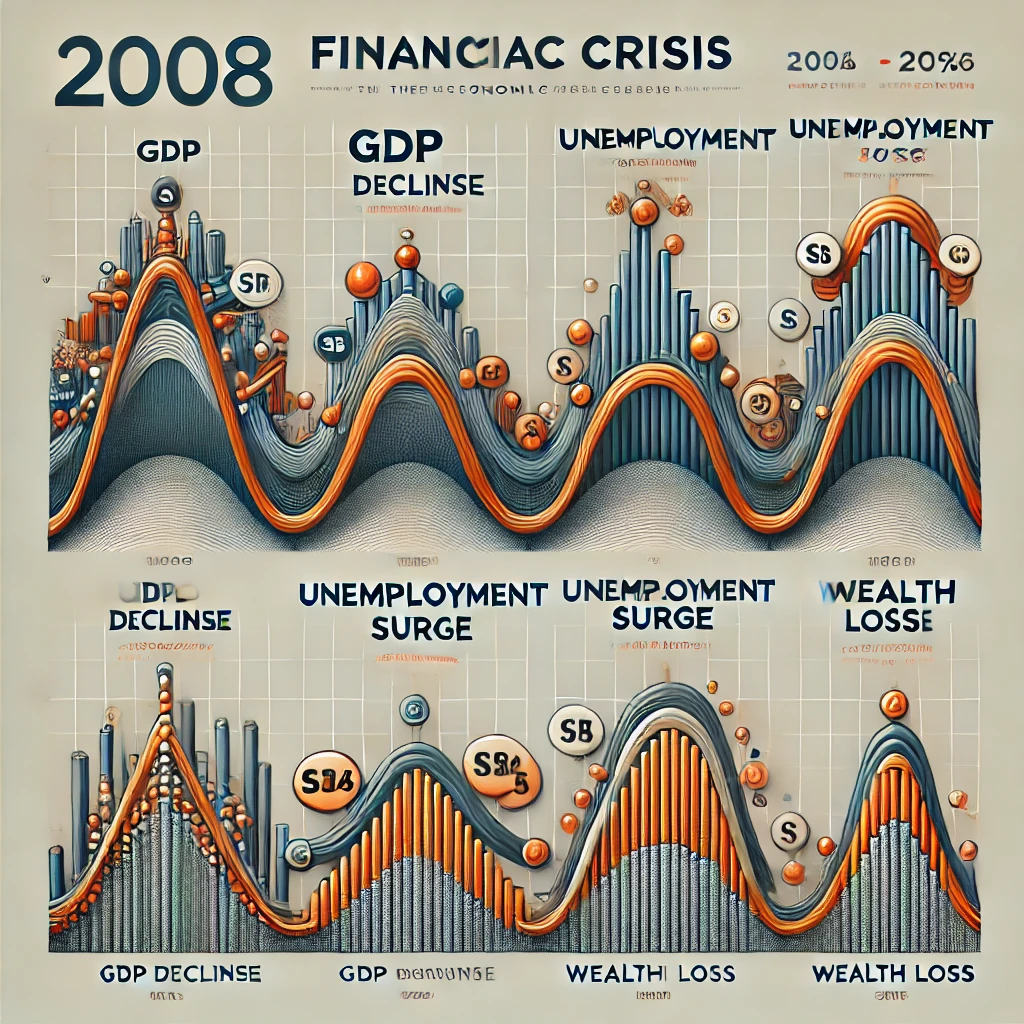

Impact on the Global Economy

The 2008 crisis had far-reaching impacts on the global economy, including significant declines in GDP, soaring unemployment rates, and massive losses in wealth. The crisis exposed vulnerabilities in the global financial system, prompting a period of economic contraction and stagnation.

Government and Regulatory Responses

Governments and central banks worldwide implemented measures to stabilize financial markets and stimulate economic growth. These included monetary policy interventions like quantitative easing and lowering interest rates, as well as fiscal stimulus programs. Additionally, new regulations and reforms enhanced financial oversight, improved transparency, and reduced systemic risk.

The Current Financial Crisis

Causes and Contributing Factors

The current financial crisis involves economic, geopolitical, and social factors creating uncertainty and instability. Factors include high debt levels, economic inequality, trade disputes, and the ongoing impact of the COVID-19 pandemic.

Impact on the Global Economy

The current crisis has widespread effects, with reduced economic growth, increased unemployment, market volatility, and heightened financial stress among individuals, businesses, and governments.

Government and Regulatory Responses

Governments and central banks are employing various policy measures to address the current crisis, stabilize financial markets, support economic growth, and mitigate negative effects. These measures include monetary policy interventions, fiscal stimulus programs, and targeted support for vulnerable sectors and populations.

Key Differences Between the Two Crises

Root Causes and Triggers

The 2008 crisis was driven by the U.S. housing market collapse and mortgage-backed securities failure. The current crisis has a more complex set of factors, such as high debt levels, trade disputes, and COVID-19’s lingering effects.

Role of Financial Institutions and Markets

In 2008, financial institutions and markets played a central role, with excessive risk-taking, lack of transparency, and inadequate regulation contributing to the crisis. The current crisis is less directly tied to financial institutions’ actions, with broader economic, social, and geopolitical forces at play.

Government and Central Bank Interventions

Both crises prompted government and central bank interventions, but the nature and scale of these measures differ. Lessons from 2008 influence policy responses to the current crisis, emphasizing systemic risks, enhancing financial stability, and promoting inclusive economic growth.

Socioeconomic and Geopolitical Implications

The socioeconomic and geopolitical implications of the two crises differ, with the current crisis potentially having more diverse consequences. COVID-19 has exposed and exacerbated existing inequalities, challenging policymakers to address immediate economic fallout and broader societal implications.

Lessons Learned from the 2008 Crisis and Their Application to the Current Crisis

Strengthening Financial Regulation and Oversight

One key lesson from 2008 is the importance of robust financial regulation and oversight to maintain stability and prevent excessive risk-taking. Policymakers can apply this lesson to the current crisis by enhancing regulatory frameworks, ensuring transparency, and monitoring systemic risks.

Managing Systemic Risk and Financial Stability

The 2008 crisis highlighted the need for effective management of systemic risks and financial stability. This lesson guides policymakers in implementing measures that minimize future crises, such as macroprudential policies and stress testing for financial institutions.

Fostering Economic Resilience and Inclusive Growth

The aftermath of the 2008 crisis underscored the importance of fostering economic resilience and inclusive growth to reduce vulnerability to future shocks. Policymakers can apply this lesson by prioritizing policies promoting sustainable and equitable economic growth, such as investing in infrastructure, education, and social safety nets.

The Path Forward: Addressing the Challenges of the Current Financial Crisis

Prioritizing Financial Stability and Sustainable Growth

To navigate the current crisis, policymakers must prioritize financial stability and sustainable growth. This involves monetary, fiscal, and regulatory measures to stabilize financial markets, support economic recovery, and address underlying vulnerabilities.

Enhancing International Cooperation and Coordination

Addressing the current crisis requires effective international cooperation. Countries can share resources, knowledge, and best practices and develop coordinated policy responses. Strengthening international collaboration can mitigate negative impacts and promote a resilient and stable global economy.

Adapting to a Rapidly Changing Economic Landscape

The current crisis highlights the need for adaptability. Policymakers, businesses, and individuals must respond to evolving challenges and seize new opportunities. Embracing innovation, fostering lifelong learning, and promoting economic diversification can build resilience.

Conclusion

The current financial crisis presents unique challenges and opportunities compared to 2008. By examining key differences and applying lessons from 2008, policymakers can better understand the current crisis and develop effective strategies. Prioritizing financial stability, sustainable growth, and international cooperation will be essential in navigating the crisis and building a resilient and inclusive global economy.

*****************************************************************************************************************************************

Khaled (Kal) Hawari is based out of Canada, Ottawa, and is well versed in finance, accounting and fintech. With many years of experience in studying DeFi, traditional bluechip investments as well as graduating top of his class in undergrad, this article is a combination of personal opinion and research. From time to time, inspiration kicks in, and a drastically different topic of interest will be discussed and shared here!

Be sure sure to follow Khaled (Kal) Hawari on the following sites!

Socials

LinkedIn

YouTube

X (previously Twitter)

FaceBook

Instagram

Flickr (username khhawari92 or click the hyperlink!)

Important links for your consideration:

- Crunchbase

- Blogger

- Spreaker

- Wakelet

- Issuu

- Behance

- Medium

- DeviantArt

- Scoop.it

- Linktree

- Muckrack

- Soundcloud

- 500px

- About.me

- Scoop.it

- Wakelet

- Behance

- Pearltrees

- 500px

- DeviantArt

- Diigo

- Padlet

- Tripadvisor

- Blogger

- That AI Blog

- Issuu

- Edocr

- Diigo

- Slideshare

- Slideserve

- Instapaper

- Scoop.it

- Behance

- Wakelet

- Muckrack

- Padlet

- Pearltrees

- Open Spotify

- Anchor.fm

- Spreaker

- Podbean

- Soundcloud

- The Gig Economy: A Conversation with Khaled Hawari(Opens in a new browser tab)

- Blog(Opens in a new browser tab)

- Strategic Planning(Opens in a new browser tab)

- Artificial Intelligence in 2023: Impact and Ethics(Opens in a new browser tab)

- Ottawa Housing Market Insights: A Deep Dive with Khaled Hawari(Opens in a new browser tab)

- About(Opens in a new browser tab)

- Achieve Financial Success: Khaled Hawari’s Comprehensive Approach to Wealth Management(Opens in a new browser tab)

- The Rise of Fintech Startups in Ottawa: Opportunities and Challenges(Opens in a new browser tab)

- Expert Risk Management: Secure Your Finances with Khaled Hawari in Ottawa

- DeFi Revolution: Unlock Financial Freedom in Ottawa

- Book Now

- The Impact of Artificial Intelligence on the Accounting Profession

- Bank Consolidation and Cryptocurrency: Exploring Their Impact on Global Finance

- Introduction: Envisioning the Metaverse Future

- The Crisis of Food Affordability in Canada: An Interview with Khaled Hawari

- Privacy Policy

- AI in Accounting: Transforming the Financial Landscape in Ottawa

- Master Financial Crises: 2008 Lessons for Today’s Survival

DeepSeek vs ChatGPT: The Ultimate AI Rivalry

AI’s development, particularly in NLP, has been a gradual process marked by groundbreaking advancements. OpenAI’s ChatGPT led this charge…

Feb 06, 2025 / Read More

Apple’s Approach to AI: Innovation Rooted in Privacy and Usability

This article explores Apple’s latest developments in AI, shedding light on how the company is reimagining the future of technology while …

Feb 06, 2025 / Read More

The Quantum Puzzle: Unlocking the Secrets of Consciousness

Quantum mechanics and consciousness are two of the most intriguing and profound subjects in modern science. Since its inception in the ea…

Feb 05, 2025 / Read More

AI in Accounting: Transforming the Financial Landscape in Ottawa

Introduction

Feb 05, 2025 / Read More

The Rise of Fintech Startups in Ottawa: Opportunities and Challenges

Khaled (Kal) Hawari is based out of Canada, Ottawa, and is well versed in finance, accounting, and fintech. With many years of experience…

Jul 06, 2024 / Read More

The Impact of Artificial Intelligence on Ottawa’s Job Market

Khaled (Kal) Hawari is based out of Canada, Ottawa, and is well versed in finance, accounting, and fintech. With many years of experience…

Jul 06, 2024 / Read More

Celebrating Ottawa’s Vibrant Summer 2024: Festivals, Events, and More

Posted on: July 6, 2024Author: Khaled (Kal) Hawari

Jul 06, 2024 / Read More

The Future of Wealth Management: Strategies, Innovations, and Trends in 2024

Khaled (Kal) Hawari is based out of Canada, Ottawa, and is well versed in finance, accounting and fintech. With many years of experience …

Jun 09, 2024 / Read More

The Future of Sustainable Investing: Trends, Strategies, and Impact

Khaled (Kal) Hawari is based out of Canada, Ottawa, and is well versed in finance, accounting and fintech. With many years of experience …

Jun 09, 2024 / Read More

Khaled Hawari Ottawa: A Finance and Accounting Expert with Global Expertise

In the ever-evolving world of finance and accounting, professionals who possess extensive expertise and a multicultural perspective are h…

Feb 14, 2025 / Read More

The Power of Detailed Bookkeeping, Strategic Planning, and Tax Expertise for Your Business…

As a business owner or entrepreneur, the foundation of your success rests on several crucial pillars — financial management, planning for…

Jan 31, 2025 / Read More

Khaled Hawari Ottawa: The Strategic Planner Guiding Businesses to Success

In the dynamic world of business, staying ahead of the curve requires more than just intuition — it demands strategy, foresight, and the …

Jan 17, 2025 / Read More

Khaled Hawari Ottawa’s Approach to Efficient Financial Reporting and Taxation

Precision and knowledge are critical in the financial and accounting fields. Khaled (Kal) Hawari Ottawa, a distinguished finance and acco…

Dec 16, 2024 / Read More

How Khaled Hawari Ottawa Language Skills Boost His Finance Expertise

In today’s globalized business world, the ability to communicate across different languages is more than just an advantage — it’s a criti…

Aug 12, 2024 / Read More

Kal Hawari Ottawa’s Approach to Implementing IFRS Standards

Khaled (Kal) Hawari, an esteemed finance and accounting professional based in Ottawa, brings a wealth of experience to the field. His tri…

Jul 25, 2024 / Read More

Khaled (Kal) Hawari: Mastering Finance and Accounting in Ottawa

In the bustling city of Ottawa, a name stands out in the field of finance and accounting: Khaled (Kal) Hawari. With an impressive career …

Jun 13, 2024 / Read More