Finance

-

Crypto Tax Loss Harvesting for Canadians: Turn Losses Into Tax Savings

Read More: Crypto Tax Loss Harvesting for Canadians: Turn Losses Into Tax SavingsCrypto investors can offset gains with losses through tax loss harvesting. Khaled Hawari explains how to maximize this strategy while following CRA rules.

-

Business Succession Planning for Ottawa Entrepreneurs: Protect Your Legacy

Read More: Business Succession Planning for Ottawa Entrepreneurs: Protect Your LegacyExit planning and succession strategy ensure your business transfers smoothly. Khaled Hawari explains tax-efficient business transition planning for Ottawa owners.

-

Freelancer Tax Tips: Maximize Deductions & Build Wealth

Read More: Freelancer Tax Tips: Maximize Deductions & Build WealthOttawa freelancers face unique tax challenges. Khaled Hawari shares strategies for estimated taxes, RRSP optimization, and wealth building.

-

Maximize Your Time: Automate Bookkeeping in Ottawa

Read More: Maximize Your Time: Automate Bookkeeping in OttawaIntroduction Manual bookkeeping is one of the biggest time drains on small business owners. Between entering transactions, reconciling accounts, chasing receipts, and preparing financial reports, bookkeeping can consume 10-20 hours…

-

Crypto Regulation Changes in Canada for 2026 Guide

Read More: Crypto Regulation Changes in Canada for 2026 GuideIntroduction The cryptocurrency landscape in Canada is shifting dramatically. As we enter 2026, federal and provincial regulators have announced substantial changes to digital asset regulations, tax reporting requirements, and compliance…

-

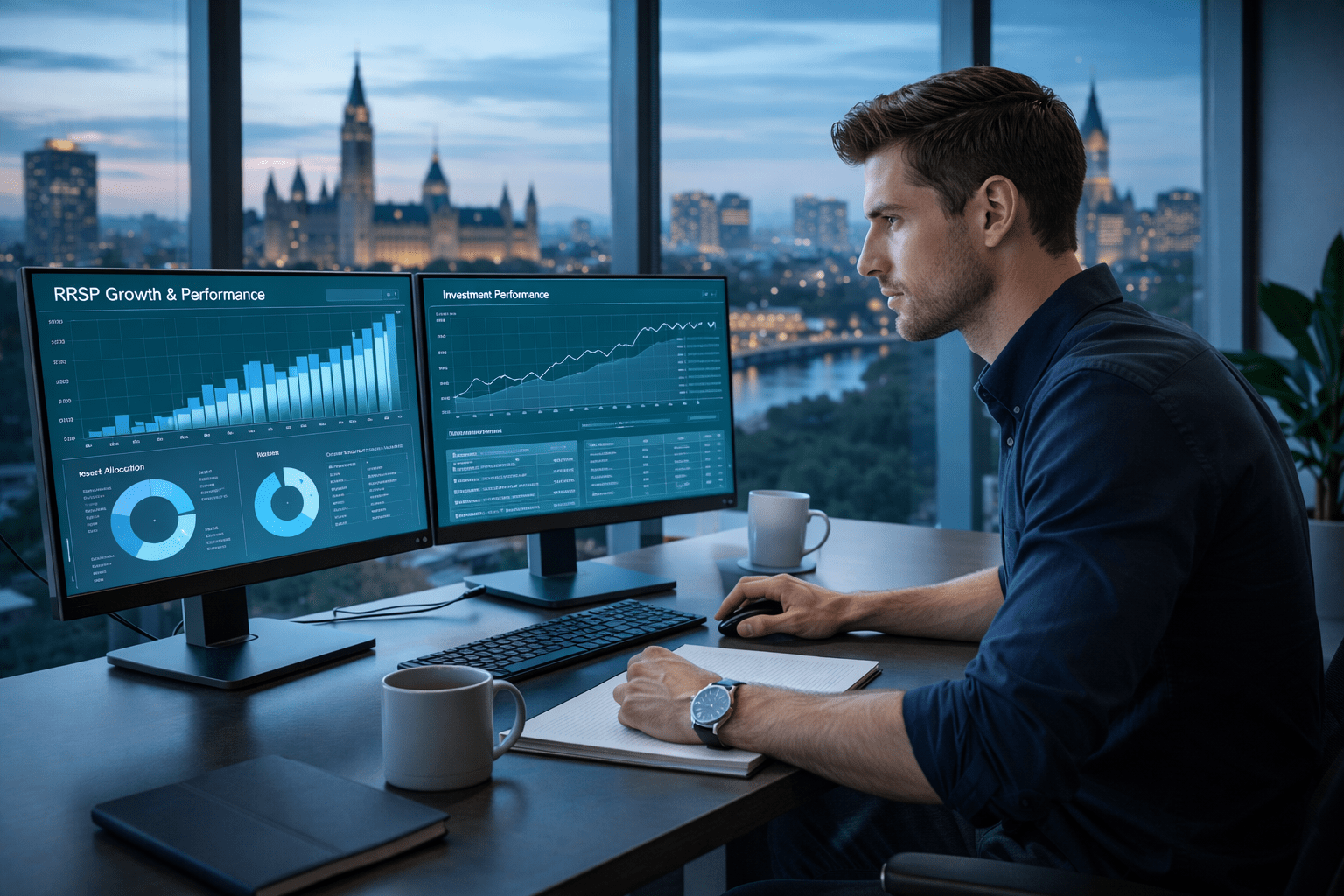

RRSP Strategies for Tech Workers in Ottawa

Read More: RRSP Strategies for Tech Workers in OttawaIntroduction Ottawa’s tech sector is booming. Whether you’re a software engineer at Shopify, product manager at Kinaxis, data scientist at Cognizant, or work at dozens of other tech companies across…

-

AI Accounting 2026: Impact on Tax Preparation

Read More: AI Accounting 2026: Impact on Tax PreparationIntroduction Artificial intelligence has transitioned from theoretical future to operational reality in accounting. As we enter 2026, Canadian accountants, bookkeepers, and tax professionals—particularly those in Ottawa—must understand how AI is…

-

RRSP Strategies for Crypto Investors in Canada: Tax-Deferred Growth Guide

Read More: RRSP Strategies for Crypto Investors in Canada: Tax-Deferred Growth GuideIntroduction For Canadian cryptocurrency investors, the RRSP (Registered Retirement Savings Plan) represents one of the most powerful tax optimization tools available—but most people don’t know they can use it to…

-

Cryptocurrency Tax Reporting for Canadian Residents: Complete 2025 Guide

Read More: Cryptocurrency Tax Reporting for Canadian Residents: Complete 2025 GuideIntroduction For Canadian cryptocurrency investors and traders, tax season brings unique challenges that many don’t anticipate. Unlike stocks purchased through traditional brokers, crypto transactions exist in a regulatory landscape that’s…

Founder’s Story

Savannah Hartley is the Founder and CEO of LuxeVisage Studio, where personal care meets permanent beauty solutions in a setting that’s as welcoming as a friend’s living room. Her studio is a testament to the power of enhancing confidence through natural beauty.

Categories

Our Services

Booking

Pick a time for your next appointment – it’s quick and easy.